Inheritance Tax Threshold 2025 Scotland

Inheritance Tax Threshold 2025 Scotland. The tables below are ‘ready reckoners’, showing estimates of the effects of illustrative tax changes on tax receipts from 2025 to 2026, 2026 to 2027, and 2027 to 2028 fiscal years,. The estate of someone who passes away encompasses a number of different things,.

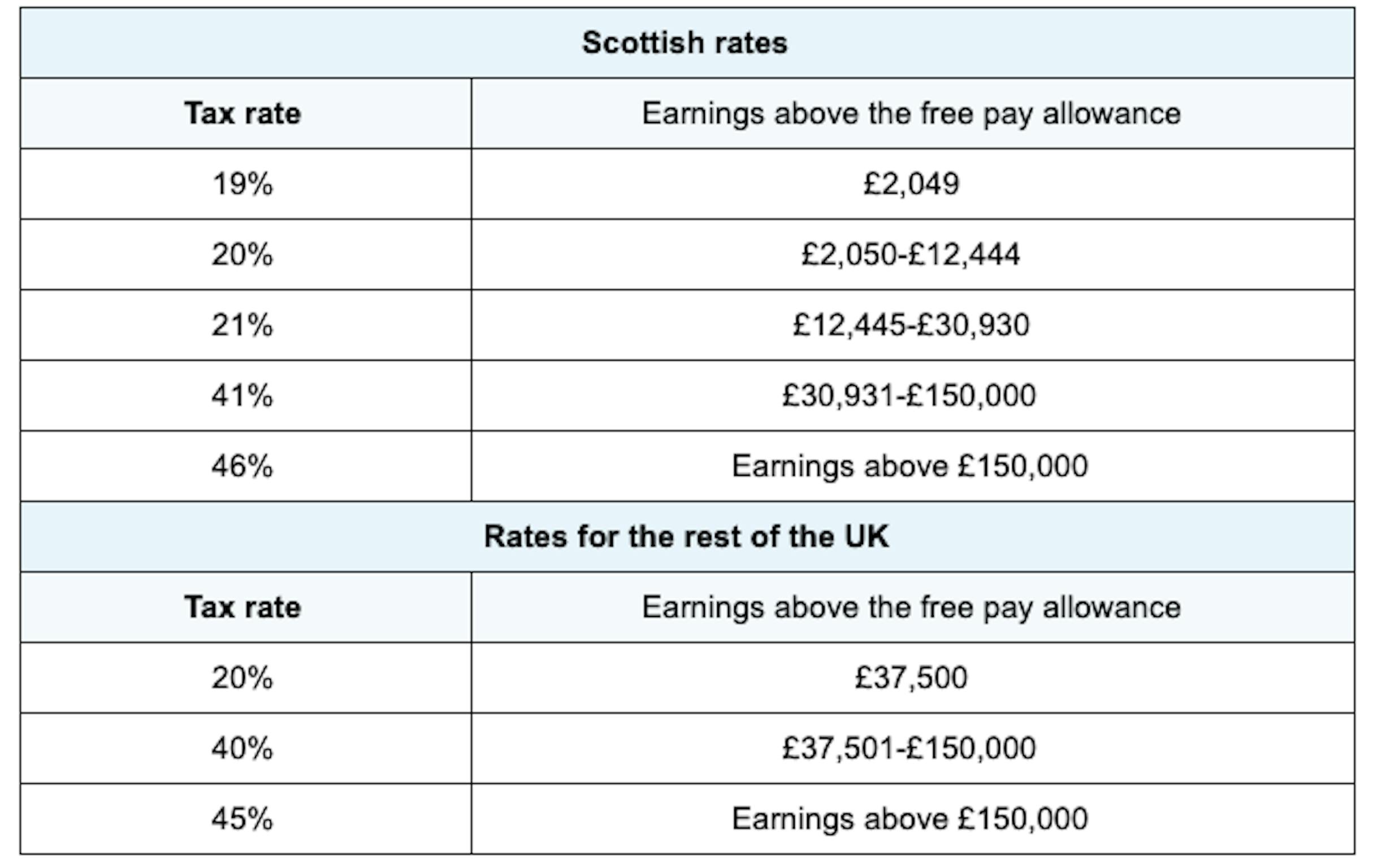

The value of the estate is. The standard inheritance tax rate is 40% with this only being charged on the part of the estate above the aforementioned threshold.

What are the Inheritance Tax Thresholds and Rates in Scotland? MM Legal, Inheritance tax applies a flat rate of 40% to the value that exceeds the threshold amount.

2025 Tax Rates And Deductions Table Emma C Ferguson, Find out how inheritance tax (iht) works, how to reduce it, and use our.

Understanding Inheritance Tax Scotland Oxfordshire Plan, In the 2025/2025 year, the first £325,000 is.

Inheritance Tax Threshold 2025/2025 Matty Sisely, Findings in the nfu’s own impact analysis.

Inheritance Tax threshold 'should be doubled' poll shows how Brits, Ahdb has calculated 42,204 out of 54,938 farms (76.8%) in england.

Estate Taxes and Inheritance Taxes in Europe Tax Foundation, Inheritance tax is a tax on an estate (the property, money and possessions) of someone who's died.

Inheritance Tax Threshold 2025 Pdf Tove Ainslie, The standard inheritance tax rate is 40% with this only being charged on the part of the estate above the aforementioned threshold.